The Chronicle: Issue 2013-35, September 10, 2013

|

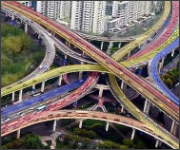

What's Going Through The Intersection of Insurance and Technology?

Brokers Could be Crucial in the Evolution of Usage-Based Insurance |

|

Telematics

IMS introduces innovative next-generation fleet solution

Intelligent Mechatronic Systems, a leading Connected Car company, has previewed its next-generation IMS Fleet Intelligence solution at Insurance Telematics USA 2013. IMS Fleet Intelligence provides a highly accurate solution at a competitive, all-in-one price point for fleets of all sizes. The initial feature set is ideal for the underserved, smaller-sized fleet market of two to fifty vehicles.

Towers Watson survey: U.S. drivers overwhelmingly receptive to usage-based auto insurance

U.S. drivers are predominantly open-minded to purchasing usage-based auto insurance (UBI) policies, or “pay as you drive” insurance, according to a new survey by Towers Watson, a global professional services company. The survey results are a clear indication that UBI is gaining momentum in the marketplace, with more consumers willing to let insurers monitor their driving habits with a telematics device in exchange for potential savings on their car insurance.

Technology

InEdge: the impact of SaaS Business intelligence on insurers

Insurance Business Analytics consultancy InEdge has completed its analysis of Software as a Service (SaaS) and its impact on Business Intelligence for insurance companies, revealing unexpected repercussions for insurers considering enterprise-wide Business Intelligence under an SaaS deployment model.

Distribution

Novinsoft releases Equitable Life Final Protection Quote and Illustration

Novinsoft Inc. has announced the release of the easy-to-use Equitable Life Final Protection Quote and Application Sales Illustration System. A new simple-issue whole life insurance product, Final Protection provides lifetime coverage with eligibility based on just a few simple health questions; no medical exam is required.

Business of Insurance

Munich Re expects largely stable renewals at 1 January 2014 for its own portfolio

Munich Re sees opportunities in the increased use of reinsurance by primary insurers for risk and capital management. "The overall economic situation remains clouded by uncertainty. Reinsurance is still indispensable for many primary insurance clients because of their growing need for tailor-made solutions", said Torsten Jeworrek, Munich Re Board member responsible for global reinsurance business.

Guy Carpenter ranks rising sea levels as greatest climate change threat

Guy Carpenter & Company has released an analysis of the evolving risk landscape spurred by global warming. Climate change, global warming and the resulting landscape shift for risk management is a growing area of concern among governments, the general public, the private sector and the (re)insurance industry at large.

Swiss Re: The structure of marine and airline insurance markets and products is slowly changing

With trade and travel rising, the structure of marine and airline insurance markets and products is slowly changing, argues Swiss Re's latest sigma study. Large claims have fallen, but the scale and complexity of transportation risks keep rising, so the potential for severe claims remains high. New insurance hubs such as Singapore and Dubai are increasingly competing with the established London Market. And new challenges in the airline and transportation industry provide scope for innovation.

Manulife Financial implements travel insurance business arrangements with RBC Insurance

Manulife Financial has implemented its previously announced travel insurance business arrangements with RBC Insurance Company of Canada. Under these arrangements, Manulife has agreed to reinsure the travel coverage sold by RBC Insurance through travel agencies. These arrangements include the transfer of sales and distribution support for the travel agency business from RBC Insurance to Manulife.

Economical Insurance integrating management of BC personal insurance business under wholly-owned subsidiary, Family Insurance Solutions Inc.

Economical Insurance and Family Insurance Solutions Inc. have announced that Economical is integrating the distribution, underwriting and policy administration of all its BC personal auto and property insurance under Family Insurance Solutions. This single point of contact model in BC will eliminate duplication, increase efficiency and simplify decision-making for brokers and policyholders in the province.

Aviva Canada introduces enhanced protection for high-value items with Ovation™

Aviva Canada, one of the country's leading providers of home, auto, recreational vehicle, group and business insurance, announces the launch of Ovation™, a new choice in insurance coverage designed specifically for high-value homes, vehicles and possessions.

Guy Carpenter mid-year report highlights catalysts for growth in (re)insurance industry ranks

Guy Carpenter & Company has released its mid-year market report, highlighting a time of dynamic capital growth in the reinsurance industry. As investors supply capacity through a convergence of alternative and traditional vehicles, the report details the ways in which this new supply of capital and excess capacity has changed the nature of the sector's capital structure.

Consumer Information

Manulife Financial launches CoverMe Easy Issue Life insurance plan

Manulife Financial has launched the latest in its suite of CoverMe™ life insurance products. The CoverMe Easy Issue Life insurance plan is simple, straightforward life insurance that can be purchased online or over the phone.

Kanetix to deliver travel insurance rates direct from TIC Travel Insurance

Travellers getting quotes for TIC Travel Insurance products on Kanetix.ca can now get rates directly from TIC, thanks to a recently launched interface. The new interface enables instant rates and online medical underwriting-straight from TIC via Kanetix.ca. This exciting initiative makes it easier for travellers to purchase coverage right away.