The Chronicle: Issue 2015-47, November 24, 2015

|

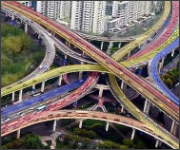

What's Going Through The Intersection of Insurance and Technology?

The Two-Edged Sword of Technology: Cutting Your Path to the Future |

|

Business of Insurance

The Guarantee announces a new partnership with Insurance Search Bureau of Canada

The Guarantee is pleased to announce a new partnership with ISB Canada and its sister companies, AFIMAC and ASAP Secured. As leaders in their fields of background screening, investigations and security services, this new partnership will provide our transportation clients with preferred pricing and access to an enterprise suite of risk management products and services tailored to the transportation industry. Our transportation clients will also gain online access to an industry leading Driver Qualification platform and Social Media investigation products, as well as security consulting and solutions, investigation services and education.

Manulife and MaRS announce partnership dedicated to financial technology innovation

Manulife has partnered with MaRS Discovery District, continuing to transform how it connects with customers worldwide by collaborating with innovators and startups on forward-thinking solutions. Manulife will be a part of MaRS' FinTech Cluster, and will join companies like Airbnb, Facebook Canada, Moneris, PayPal and other startups at the centre. As part of the new partnership, MaRS will become Manulife's Toronto location for its Lab of Forward Thinking (LOFT). Centered on innovation, the tangible LOFT spaces provide a platform for employees across the company to collaborate and devise new technological solutions for Manulife's various wealth and asset management, and insurance business lines.

Telematics

IRC: Telematics devices prompt changes in driving behavior

More than half of the drivers participating in an Insurance Research Council public opinion survey have made changes in how they drive since installing a telematics device provided by their insurance company in their primary vehicle. More than one third of respondents said they have made small changes in how they drive, and nearly 1 in 5 said they have made significant changes; more than one third have made no changes in their driving practices since having a device installed. Drivers aged 65 and above were significantly less likely than other drivers to report making changes in how they drive.

Claims

InEdge: Gaining a competitive advantage through claim analytics

There are a number of strategies claim managers can enact to achieve the gains in competitive advantage for their organization. Having access to insurance analytics can help claim managers in a number of ways. An insurance analytics solution geared towards claim managers should contain metrics that give visibility into the variance between target objectives and actual results.

Benchmark: Self-driving cars ‘off-shoot’ technology can make an immediate impact

We have been following the on-going testing and evolution of the self-driving car and car technology in general for quite some time and it is interesting to note that Waterloo, ON, already a technology hot-bed, will be the first jurisdiction in Canada to allow road testing of automated vehicles. Ontario Transportation Minister Steven Del Duca announced during a speech at the University of Waterloo that the province will allow testing of self-driving cars, as well as related technologies, starting on January 1, 2016. The provincial government is also pledging support to the Ontario Centres of Excellence Connected/Automated Vehicle Program, which pairs academic institutions with businesses to further transportation technology. Brad Duguid, the province’s Minister of Economic Development said that the technology is inevitable and that “we intend to be leaders in this disruptive technology.”

|

ICTC2016: “Technology: A Two-Edged Sword” |

New for 2016: |

ICBF2016: “Brokers on the Digital Expressway” |

||

|

Whether you attend the Technology Conference, the Broker Forum, or both – or if you can't make it during the day – join our plenary session starting at 4:00pm on Monday, Feb. 29, for an expert presentation and panel, the ICTA Awards and a networking reception. Becoming a fully digital insurer or broker has been a top priority for leaders for the past two years, but many companies are still early in their transformation, lacking the needed technologies, processes and business models to succeed in an increasingly competitive and digital market. In her keynote presentation, “Digital Transformation: Becoming a Digital Insurer or Broker,” Gartner's Kimberly Harris-Ferrante will define the digital insurance model, outline best practices, and present research showing progress toward the digital goal. Registration is open. For complete details, see Technology Conference (ICTC2016) and Broker Forum (ICBF2016). |

||||

Distribution

Industrial Alliance Securities acquires Burgeonvest Bick Corporation

Industrial Alliance Securities has announced the signing of an agreement to acquire Burgeonvest Bick Corporation, the sole shareholder of Burgeonvest Bick Securities Limited, a securities brokerage firm and IIROC dealer member. This transaction is in line with IAS's strategic focus on adding new distribution in Canada.

Consumer Information

FPSC: Canadians lack confidence in achieving their financial goals

As Canada recognizes its 7th annual Financial Planning week, Financial Planning Standards Council has just released the results of a new study which confirms that the majority of Canadians lack confidence in their financial knowledge. New global research commissioned by the Financial Planning Standards Board, in partnership with FPSC in Canada, reveals that most Canadians do not have strong confidence that they will achieve their financial life goals and that fewer than 1 in 5 Canadians strongly agree that they are knowledgeable about financial matters.

The Co-operators partners with TIRF to reduce distracted driving in Canada

Research suggests that distracted driving is a substantial factor in road fatalities, and may be equal to or even exceed impaired driving in at least some jurisdictions in Canada. As part of its Drive out Distraction program, The Co-operators has announced a new partnership with the Canadian Traffic Injury Research Foundation aimed at reducing the incidence of distracted driving in Canada. The announcement was made on the National Day of Remembrance for Road Crash Victims.

Benchmark IME: Will the new distracted driving penalties prove effective?

With all of the recent media coverage, for most of us, it is not news that the fines and penalties for distracted driving in Ontario have increased as of September 1, 2015. Those are certainly stiff penalties, particularly for novice drivers; however, it must be noted if you endanger others because of any distraction (i.e. your distracted driving results in an accident), including both hand-held and hands-free devices, you can also be charged with careless driving. Depending on the nature of the incident you could even be charged with dangerous driving (a criminal offence), with jail terms of up to five years.

IBAO urges drivers to prepare for winter road conditions

The Insurance Brokers Association of Ontario (IBAO) is urging drivers in Ontario and across Canada to follow the recommended steps to appropriately prepare for the winter roads ahead. Brokers recommend drivers install winter snow tires and visit a local mechanic to have their cars serviced before winter arrives in earnest. Ontario drivers are encouraged to contact their local broker regarding the new winter tire insurance discount in effect as of January 1st, 2016.

CCMTA marks National Day of Remembrance for Road Crash Victims

Since 2007, the third Wednesday of November has been set aside for Canadians to remember those who have lost their lives or been seriously injured on Canadian roads. Each year in this country, almost 1,900 people are killed on road crashes and almost another 165,000 are injured. On average, five people die on Canada's roads each day.