The Chronicle: Issue 2015-22, June 2, 2015

|

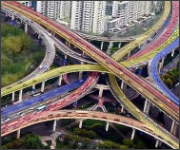

What's Going Through The Intersection of Insurance and Technology?

Modern Technology, “Muddling Through,” and Insurance Management

ORBiT 2015: Digital Lively, but CRM May Still Be Dead |

|

Business of Insurance

Aon: Western countries face increased terrorism threat

Risk levels are rising in Western economies due to the increased terror threat presented by Islamic extremists according to the Aon Terrorism and Political Violence Map. Launched by Aon Risk Solutions, the global risk management business of Aon plc, in partnership with The Risk Advisory Group, the map provides insight for business aiming to reduce risk exposures. Top risks for business include increased terrorism threats across developed economies, and a progressively uncertain and dangerous geopolitical environment, where the risk of armed conflict is growing amid changing and unstable regional balances of power.

CCIR: regulators sign Memorandum of Understanding to share industry conduct information

Four members of the Canadian Council of Insurance Regulators have signed a memorandum of understanding (MOU) that sets out the terms for cooperation and exchange of information across provincial and territorial jurisdictions simpler and more effective, Chair Patrick Déry has announced. The remaining CCIR members are expected to join their counterparts in British Columbia, Alberta, Ontario and Quebec and sign on to this new MOU in the coming months.

Technology

IBM and ThinkData Works Partner to Make Open Data More Accessible

IBM has announced it is now offering ThinkData Works' open data solution on IBM's platform-as-a-service, Bluemix, to give application developers access to clean, open data from all levels of government in Canada. By building up-to-date and relevant public data directly into Bluemix, IBM and ThinkData Works' Namara.io are providing developers, business, and citizens with the resources they need to innovate and build data-driven applications and services that can help solve industry problems and address new challenges in ways previously unavailable.

Gartner: Customer Relationship Management Software market grew 13.3 percent

Worldwide customer relationship management (CRM) software grew 13.3 percent from 2013 to 2014, according to Gartner, Inc. Overall, the top 10 CRM vendors accounted for more than a 60 percent share in 2014, growing 14 percent over 2013. However, with the notable exceptions of Salesforce and Microsoft, most vendors in the top 10 only held their positions or they lost share in 2014. "Large vendors leveraged their acquisitions to extend their position in new markets and to enrich the depth of their current feature sets in 2014," said Joanne Correia, research vice president at Gartner. "We saw market consolidation continue, and price wars started quickly as large vendors fought to keep their installed base from moving to other vendors and to stop the descent of their maintenance revenue."

InEdge debuts Underwriting Performance Analytics solution

Insurance Analytics leader InEdge has announced the availability of its Underwriting Performance Analytics™ solution. This turn-key solution utilizes the basic data transactions from an Insurer's source systems and allows underwriting managers and executives to monitor and fine-tune the performance of underwriting teams in their charge. It presents accurate and reliable metrics for analysis via intuitive visual dashboards and reports. Underwriting Performance Analytics™ joins the InEdge suite of Analytics solutions already serving Property and Casualty insurers of all sizes.

Distribution

Applied Systems: Integro selects EpicOnline to standardize business operations and drive growth

Applied Systems has announced that Integro Ltd., one of the largest independent insurance brokerage and risk management firms in the world, will leverage Applied EpicOnline across its U.S. and Canadian-based offices to standardize its business operations and reporting, and centralize data on a single integrated software application. Applied EpicOnline is the cloud-hosted version of the fastest-growing agency and brokerage management system in the world, delivering the most technologically advanced software to agencies and brokerages to enable faster growth and profitability in a changing insurance marketplace.

Empire Life launches CITS e-Application notification feeds

The Empire Life Insurance Company has launched e-Application data feeds for life insurance applications placed through the Fast & Full™ Life Application Process. This will make settling Fast & Full business even faster for Managing General Agents using data management system providers enabled to receive these feeds. Empire Life received Canadian Life Insurance EDI Standards (CLIEDIS) approval for their CITS e-Application data feed process.

Claims

ClaimsPro Strengthens its Atlantic Canada Coverage with Acquisition of Plant Hope Adjusters

ClaimsPro has announced that it has acquired the leading Atlantic Canada adjusting service, Plant Hope Adjusters Ltd. Plant Hope is the largest employee-owned regional independent adjusting service in Atlantic Canada. With 11 offices and 42 adjusters operating in the Maritime Provinces, Plant Hope provides services in complete loss investigation, marine surveying, and claims management to insurers.

Consumer Information

SGI CANADA to add automatic Legal Expense coverage to Saskatchewan home policies

Good insurance is an act of care, and SGI CANADA cares about customers. That's why it's become the only insurer in Saskatchewan to offer DAS Legal Expense insurance as an included coverage in all home policies – including home plans in Agro Pak policies, as of July 1, 2015.

In The Community

WICC supports the Canadian Cancer Society's Relay For Life

Women In Insurance Cancer Crusade (WICC) is pleased to once again support the Canadian Cancer Society's Relay For Life events across Ontario. This year, WICC will host the first-ever insurance industry-exclusive Relay For Life event in downtown Toronto on June 12th at the Garrison Commons at Fork York.