The Chronicle: Issue 2014-40, October 7, 2014

|

What's Going Through The Intersection of Insurance and Technology?

Data Science Implementations: Keep Your Eye on the MoneyBall |

|

Claims

AudaExplore launches new Decision Science Platform

AudaExplore, the US business unit of Solera Holdings Inc. and a leading global data-driven solution provider to insurance carriers, repairers, dealerships, fleet owners and suppliers, has introduced a Predictive Analytics Solution as part of its new Decision Science Platform. The Predictive Analytics Solution, which is fully integrated with AudaExplore Estimate Check, is a real-time, data-driven solution that uses advanced algorithms to accurately automate business processes, increasing efficiency and productivity.

Xchanging and Proformance Group offer new third-party administration service for Canada

Xchanging plc, the business process, procurement and technology services provider, and ProFormance Group Insurance Solutions (PGIS), a Canadian-based specialized insurance services company that delivers claims, TPA, training and auditing services, have chosen the RIMS Canada conference to launch a jointly developed Third Party Administrative (TPA) service specifically tailored to meet the needs of the Canadian Market when processing London Market Business.

CLHIA releases preliminary results of prescription drug pooling initiative

The number of high-cost prescription drug claims that Canada's private insurers covered for Canadians with fully-insured supplementary health insurance plans doubled in the Canadian Drug Insurance Pooling Corporation's (CDIPC) first year of operation

Business of Insurance

Allianz Global Assistance Canada merges with TIC Travel Insurance Coordinators

Allianz Global Assistance Canada and TIC Travel Insurance Coordinators, including its subsidiary SelectCare Worldwide, will merge their travel insurance operations in Canada. Once all closing requirements have been met, the combined entity, which will operate as Allianz Global Assistance, will be one of the largest travel insurance providers in Canada.

Distribution

Cornerstone Insurance Brokers purchases Hartwell Thayer Insurance and Financial Services Ltd.

Cornerstone Insurance Brokers Ltd. is pleased to announce the purchase of Aurora-based Hartwell Thayer Insurance and Financial Services Limited, in a transaction which brings together two exceptional brokerages.

In The Community

Sun Life Financial contributes to support Ebola outbreak relief efforts

Sun Life Financial announced today it will contribute $50,000 to support relief efforts for those affected by the Ebola virus in West Africa. The contribution will come from the Sun Life Financial International Response Fund at the Canadian Red Cross, which will allow the emergency support to be deployed rapidly to the area.

Consumer Information

IBC shares top safety tips for Fire Prevention Week

While equipping your house with smoke detectors continues to be the best way to prevent a fire from damaging your home, there are other steps a family can take to ensure they are prepared against and protected from fire. This Fire Prevention Week, Insurance Bureau of Canada offers Canadians its top 10 tips for preventing fires and saving lives.

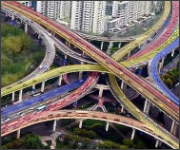

Allstate Canada survey: Canadian drivers blame traffic delays for cell phone use

Almost 40 per cent of Canadian drivers admit to checking their phones when stopped due to traffic delays, according to a recent nationwide survey on distracted driving by Leger for Allstate Canada.

IBC offers top 10 tips to detect and avoid auto insurance fraud

Insurance crime is not victimless. When fraudsters drive up auto insurance costs, you pay more for insurance. To help fight auto insurance fraud, IBC has implemented several initiatives to help prevent this costly crime and continues to advocate for legislative changes to help crack down on fraud.