The Chronicle: Issue 2013-11, March 19, 2013

|

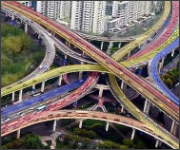

What's Going Through The Intersection of Insurance and Technology? | ||||

|

ICTC2013 – What to Leave Behind We are 25 hours from the start of registration for the 2013 Insurance-Canada.ca Technology Conference, and, after a day like yesterday, the big question is: What can we leave behind? The answer, actually, is obvious.

Advantage Brokers: Content Rules in Social |

|

|||

Telematics

IMS: UBI in Canada – the key differences and what Canadian insurers need to consider

While usage-based insurance is quickly gaining traction in the United States and United Kingdom, there is also a history of UBI programs in Canada. Aviva Canada was in the market until about two years ago, and Industrial Alliance is currently running a program in Quebec. That said, the tide is returning, and a number of insurance carriers are lining up to launch UBI programs north of the border this coming year. To find out how insurance carriers should approach their UBI “go-to” market strategy in Canada, we reached out to Blair Currie, Vice President of Marketing at Intelligent Mechatronic Systems (IMS).

Consumer Information

Title insurance indispensable for owners' peace of mind

Real estate fraud by identity theft has unfortunately become an increasingly common phenomenon today. Along with the intense anxiety property owners experience when they fall victim to these frauds, they must navigate a complex legal system to restore their title to the property. With title insurance, the owner is protected from the burden of this long, costly process, since the insurer is responsible for returning the title to the owner.

Business of Insurance

Life insurers more robust in Canada than US, reveals Ernst & Young report

Canadian life insurers enjoy a relatively good position compared to their US counterparts, says Ernst & Young. But companies need to creatively adjust their products, business strategies and services for growth in a competitive market characterized by lower margins and changing demographics.

Policy Management

Thunderhead.com P&C solution brief: What if the customer and agent communication solution you needed was already here?

The challenging economic climate has placed a sharp focus on improving operating efficiencies to reduce costs and enable greater agility to drive increased revenue. Not surprisingly, cheaper, better, faster are today's marching orders for the worldwide insurance industry. As if that wasn't enough pressure, one of the most dramatic and rapid changes in agent and customer behavior is occurring.

Farm Mutual Reinsurance Plan partners with Risk Control Technologies to offer loss control solution for Canadian mutuals

Risk Control Technologies Inc., the industry-leading provider of loss control software solutions for insurers, today announced that Cambridge, Ontario-based Farm Mutual Reinsurance Plan Inc. (FMRP) has completed the first stage of implementation of the RC Inspection software solution, aimed at streamlining its internal loss control operations.

MajescoMastek's STG Policy Administration and STG Billing selected by Maryland Automobile Insurance Fund

The Maryland Automobile Insurance Fund has selected MajescoMastek's STG Policy Administration and STG Billing solutions for legacy replacement and core processing modernization. MajescoMastek's experience in core processing, proven solutions and services, focus on personal and commercial auto market, and track record were the key reasons that MAIF chose MajescoMastek's products.

Claims

Eagle Adjusting Services selects Symbility for multi-year partnership

Symbility Solutions Inc., provider of cloud-based claims technology using the most comprehensive data for the property and casualty insurance industry, is pleased to announce that Eagle Adjusting Services, Inc., a full service national property and casualty claims independent adjusting company, has signed a multi-year agreement to integrate Symbility into its operations.

Distribution

Keal Technology and SGI Canada deliver CSIO-compliant eDoc solution to insurance brokers

CANADA and Keal Technology, a leading provider of broker management systems, have completed the development of CSIO compliant eDocs, allowing brokers to download personal lines electronic policy documents directly into Keal's Broker Management System (BMS), sigXP. The eDocs solution is now available to SGI CANADA-Keal Technology Brokers. eDocs fully automates the process of retrieving electronic policy documents directly from SGI CANADA's back-end system and attaching them to the appropriate client file in sigXP.

Economical to begin CSIO eDoc XML standard pilot with select broker partners

Beginning Monday, March 25, Economical Insurance will begin a pilot implementation of the CSIO eDoc XML standard with select brokers that use The Agency Manager, sigXP, PowerBroker or The Broker Workstation broker management systems (BMS). Upon completion of the pilot, Economical will roll out eDocs to its broker partners across the country.